5G New Infrastructures Drive Tantalum Industry Chain

5G is injecting new momentum into China’s economic development, and new infrastructure has also led the pace of domestic construction into an accelerated period.

China’s Ministry of Industry and Information Technology disclosed in May that the country was adding more than 10,000 new 5G base stations a week. China’s domestic 5G base station construction has exceeded the 200,000 mark at full capacity, with 17.51 million domestic 5G mobile phones shipped in June this year, accounting for 61 percent of mobile phone shipments in the same period. As the “first” and “foundation” of new infrastructure, 5G industry chain will undoubtedly become a hot topic for a long time to come.

With the rapid commercial development of 5G, tantalum capacitors have a broad application prospect.

With large outdoor temperature difference and multiple environmental changes, 5G base stations must have extremely high stability and long service life. This puts forward higher requirements for the quality and performance of electronic components in the base station. Among them, capacitors are indispensable electronic components of 5G base stations. Tantalum capacitors are the leading capacitors.

Tantalum capacitors are characterized by small volume, small ESR value, large capacitance value and high accuracy. Tantalum capacitors also have stable temperature characteristics, wide operating temperature range, etc. Meanwhile, they can heal themselves after failure to ensure long-term working stability. Therefore, in many cases, it is an important sign to determine whether an electronic product is a high-end product or not.

With advantages such as high frequency efficiency, wide operating temperature, high reliability and suitable for miniaturization, tantalum capacitors are widely used in 5G base stations that emphasize “miniaturization, high efficiency and large bandwidth”. The number of 5G base stations is 2-3 times that of 4G. Meanwhile, in the explosive growth of mobile phone fast chargers, tantalum capacitors have become standard due to more stable output and reduced volume by 75%.

Due to the working frequency characteristics, under the same application conditions, the number of 5G base stations is more than 4G. Data according to the ministry of industry and information disclosure, by number of 4G base stations around the country in 2019 to 5.44 million, so is construction of 5G network to achieve the same coverage requirements, or need to 5 g base stations, 1000 ~ 20 million are expected to scale from now on, if you want to achieve universal access to 5G, need to consume huge amounts of tantalum capacitor, according to market forecast, the tantalum capacitor market scale will reach 7.02 billion yuan in 2020, the future will continue rapid growth.

At the same time, with the gradual development of electric vehicles, artificial intelligence, AI, wearable devices, cloud servers, and even smart phone high-power fast charging electrical appliances market, high-performance equipment emerges, and more demands will be put on high-end capacitors, namely tantalum capacitors. Apple’s iPhone and tablet charging heads, for example, use two high-performance tantalum capacitors as output filters. Tantalum capacitors hide a market of ten billion in both quantity and scale, which will create development opportunities for related industries.

In addition, capacitors are also used in aerospace equipment more components. Because of its “self-healing” features, tantalum capacitor favored by the military market, large-scale SMT SMD tantalum capacitor, high-energy mixed tantalum capacitor used in energy storage, high reliability of tantalum shell encapsulation capacitor products, suitable for large scale parallel circuit using polymer tantalum capacitor, etc., greatly meets the requirements of the particularity of military market.

The high demand for tantalum capacitors has led to an aggravation of the stock shortage, driving the growth of the upstream raw material market.

Tantalum prices rose in the first half of 2020. On the one hand, due to the coVID-19 outbreak at the beginning of the year, the global mining volume was not as high as expected. On the other hand, due to certain transportation constraints, the overall supply is tight. On the other hand, tantalum capacitors are mostly used in electronic products. In the first half of the year, due to the impact of the epidemic, the demand for electronic products increased, leading to an increase in tantalum capacitors. As capacitors are the most important use of tantalum, 40-50% of the world’s tantalum production is used in tantalum capacitors, which drives up the demand for tantalum and drives up the price.

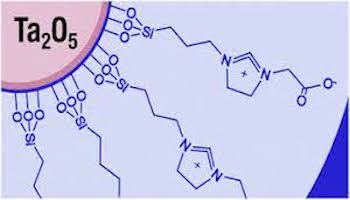

Tantalum oxide is upstream of tantalum capacitor products, industrial chain of tantalum capacitor front of raw materials, oxidation tantalum and niobium oxide in China market is growing rapidly, 2018 annual output reached 590 tons and 2250 tons respectively, between 2014 and 2018 annual compound growth rate of 20.5% and 13.6% respectively, the size of the market in 2023 is expected to 851.9 tons and 3248.9 tons, respectively, compound annual growth rate of 7.6%, the overall industry space to grow up healthy.

As the first ten-year action program of the Chinese government to implement the strategy of making China a manufacturing power, made in China 2025 proposes the development of two core basic industries, namely the new-generation information technology industry and the new material industry. Among them, the new materials industry should strive to break through a batch of advanced basic materials, such as advanced iron and steel materials and petrochemical materials, which are urgently needed in key application fields, which will also bring new opportunities for the development of tantalum-niobium metallurgy industry.

The value chain of tantalum-Niobium metallurgy industry includes raw materials (tantalum ore), hydrometallurgical products (tantalum oxide, niobium oxide and potassium fluotantalate), pyrometallurgical products (tantalum powder and tantalum wire), processed products (tantalum capacitor, etc.), terminal products and downstream applications (5G base stations, aerospace field, high-end electronic products, etc.). Since all thermal metallurgical products are produced from hydrometallurgical products, and hydrometallurgical products can also be directly used to produce part of the processed products or terminal products, hydrometallurgical products play a significant role in tantalum-niobium metallurgical industry.

The downstream tantalum-niobium products market is expected to grow, according to a report by Zha Consulting. Global tantalum powder production is expected to increase from approximately 1,456.3 tons in 2018 to approximately 1,826.2 tons in 2023. In particular, metallurgical grade tantalum powder production in the global market is expected to increase from approximately 837.1 tons in 2018 to approximately 1,126.1 tons in 2023 (i.e., a compound annual growth rate of approximately 6.1%). Meanwhile, China’s tantalum bar output is expected to increase from about 221.6 tons in 2018 to about 337.6 tons in 2023 (i.e., a compound annual growth rate of about 8.8%), according to a report by Jolson Consulting. To meet the needs of its potential customers, The company said in its prospectus that about 68.8 percent of the funds raised would be used to expand production of downstream products, such as tantalum powder and bars, in order to broaden its customer base, capture more business opportunities and increase market share.

The infrastructure construction under 5G industry is still at the initial stage. 5G is characterized by high frequency and high density. Under the premise of equal effective range, the demand for base stations is much higher than in previous communication era. This year is the year of 5G infrastructure construction. With the acceleration of 5G construction, the application demand of high-end electronic products is increasing, which drives the demand for tantalum capacitors to remain strong.